TL;DR: The average Uber personal injury settlement varies because claim value depends on injury severity, fault allocation, and which insurance coverage applies based on the driver’s app status. Injured passengers, drivers, and third parties face different outcomes since Uber’s coverage changes by driving period, evidence availability, and how medical treatment and damages develop over time.

Table of Contents

Uber personal injury settlements vary and are evaluated individually based on key factors such as injury severity, medical treatment, fault, and available insurance coverage. This case-by-case approach allows each claim to reflect the full scope of the harm and losses involved. As a result, settlement outcomes are tailored to the specific circumstances of each accident rather than a fixed range.

Other factors that can affect the settlement amount include:

- Lost income and reduced earning capacity.

- Non-economic damages, such as pain and suffering.

- The quality and availability of evidence.

Since Uber’s insurance coverage depends on whether the driver is offline, waiting for a ride, or actively transporting a passenger, similar accidents can result in very different outcomes. For this reason, Uber injury cases are evaluated individually rather than by an “average” amount.

Why Uber Personal Injury Settlements Vary

Uber personal injury settlements vary because each claim is evaluated based on its own facts, insurance coverage, and evidence. These cases often involve layered insurance policies, digital ride data, and liability questions that are not present in many standard car accidents. Even small differences in timing, app status, or how injuries develop can influence how insurers assess a claim and determine its value.

This individualized review ensures settlement outcomes reflect the specific circumstances of each Uber accident, rather than relying on a fixed formula.

Here are some of the main reasons:

- Multiple insurance policies may apply depending on the driver’s app status.

- Ride data and app records must be reviewed to confirm coverage periods.

- Disputes over fault are common, especially when several vehicles are involved.

- Medical progress is not immediate, and settlement value often depends on how injuries develop over time.

- Future damages may be uncertain, including long-term care, work limitations, or permanent impairment.

- Private settlements are not publicly disclosed, limiting meaningful comparisons.

What Factors Determine The Settlement Amount For Uber Injury Claims?

Several factors determine how much compensation you may receive after an Uber accident. Courts and insurance companies review these factors together to assess liability, damages, and available insurance coverage when evaluating a settlement.

Here are some factors that can affect your Uber personal injury settlement:

Injury Severity & Medical Treatment

More serious injuries typically require longer and more intensive care. This type of treatment increases medical costs and can raise settlement value. Insurers consider the nature of your injury and the course of treatment over time when evaluating your claim.

Here are common injuries in Uber accidents and how treatment affects settlement value:

- Traumatic Brain Injuries (TBIs) — TBIs require emergency care, imaging, hospitalization, neurological follow-up, and cognitive rehabilitation. Ongoing symptoms and future treatment needs can significantly increase claim value.

- Spinal Cord Injuries (SCIs) — SCIs may involve surgery, extended hospitalization, physical therapy, mobility aids, and long-term care. Permanent limitations strongly affect settlement evaluations.

- Broken Bones — Treatment can range from casting to surgical repair with hardware. Multiple fractures or delayed healing typically increase medical expenses and recovery time.

- Severe Burns — Severe burns often necessitate immediate medical treatment, skin grafts, wound care, and rehabilitation. Scarring and functional limitations are considered in valuation.

- Internal Organ Damage — These injuries often require surgery, inpatient care, and prolonged recovery. They are closely reviewed due to their seriousness and potential complications.

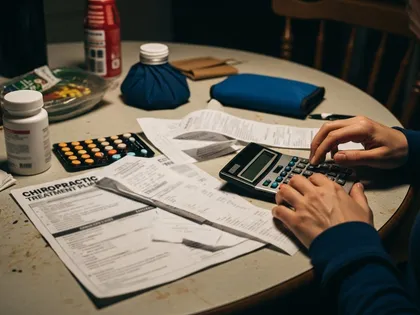

Insurers also examine the duration and consistency of your medical treatment, including:

- Hospital stays

- Surgery

- Physical therapy

- Chiropractic care

- Pain management

- Psychological counseling

Extended or specialized treatment may indicate unresolved symptoms, future medical needs, or permanent impairment. These factors can increase the overall value of an Uber personal injury claim.

Lost Income And Earning Capacity

Lost income is also a key component of many Uber personal injury claims. Injuries can prevent you from working immediately. In some cases, they may alter the type of work you can do in the long term.

Compensation may account for:

- Missed wages during recovery.

- Reduced work hours or modified duties.

- Use of sick leave or vacation time.

Insurers review pay stubs, tax records, and employment history to verify income loss. They will also use medical records to document work restrictions and limitations on recovery.

This factor becomes more significant when your injuries:

- Limit your physical movement or stamina.

- Prevent you from returning to the same job.

- Require a career change or retraining.

- Reduce future income potential.

Loss of earning capacity also addresses the future financial impact. Even if you return to work, ongoing limitations may still affect the value of your claim.

Fault Allocation

California uses a pure comparative negligence system. Under this rule, multiple parties can share fault for an accident, and insurers reduce your compensation by your percentage of responsibility. For example, if insurers assign you 20% fault, they reduce your settlement by 20%.

In some instances, liability may extend to multiple parties, depending on their role in causing the crash. These include:

- Uber Technologies, Inc., if its insurance coverage applies or platform-related conduct becomes an issue.

- The Uber driver, if negligent driving caused the collision.

- Another driver, if their actions contributed to the crash.

- A pedestrian or cyclist, if unsafe behavior led to the accident.

- A government entity, if dangerous road conditions or missing signage were involved.

- A vehicle manufacturer, if a defect contributed to the injuries.

Identifying all responsible parties helps determine fault allocation and insurance coverage. These factors directly affect the settlement amount in an Uber personal injury claim.

Non-Economic Damages

Non-economic damages often make up a significant portion of Uber personal injury settlements. California law allows you to seek compensation for losses that affect your daily life, even when they lack direct financial documentation.

These damages may include:

- Pain and suffering

- Emotional distress

- Loss of enjoyment of life

- Anxiety or trauma after the crash

These damages can increase the potential value of your Uber injury settlement when your injuries cause ongoing pain, emotional harm, or lasting limits on your daily life. To assess these losses, insurers review your medical records, the length of your treatment, and how the injury affects you over time.

Understanding Uber’s Insurance Coverage

Uber accident claims are different from regular car accidents because insurance coverage depends on the driver’s app status. This distinction often affects whether an injured person can sue Uber directly or must pursue a claim through the driver’s insurance. Uber defines coverage in terms of specific “driving periods,” and each period affects the amount of insurance available.

Uber maintains the following commercial insurance coverage:

Period 0: Driver Offline

The driver is logged out of the app and not working.

- Uber provides no coverage.

- The driver’s personal auto insurance applies.

Period 1: App On, No Ride Accepted

The driver is logged in but has not accepted a ride. Uber provides limited third-party liability coverage:

- $50,000 per person for bodily injury.

- $100,000 per accident for bodily injury.

- $25,000 in property damage per accident.

Period 2: Ride Accepted Or Passenger Onboard

The driver has accepted a trip or is transporting a passenger. Uber maintains insurance that covers at least $1 million in property damage and bodily injury. This policy applies only if the rideshare driver is at fault.

For example, if you suffer injuries while an Uber driver is logged into the app but has not accepted a ride, your claim may fall under Period 1. That coverage has lower insurance limits and may restrict the compensation available. If the driver has already accepted a trip or is carrying a passenger, higher coverage limits may apply. These differences can affect the final settlement amount in Uber personal injury cases.

California Insurance Law For Rideshare Drivers

Uber classifies its drivers as independent contractors. This classification affects which insurance policies apply after an accident rather than making Uber automatically responsible for every crash.

Two key laws shape how rideshare injury claims are handled in California:

- Assembly Bill 5 (AB5) — Established standards for determining whether a worker is an employee or an independent contractor.

- Proposition 22 (2020) — Exempted app-based rideshare and delivery drivers from employee status while providing limited benefits.

Together, these laws help determine how responsibility is evaluated and which insurance coverage may apply in Uber personal injury cases.

California also sets minimum insurance requirements for private vehicles. These rules help explain why insurance limits often become a settlement issue in Uber accidents. Minimum liability coverage is set at:

- $30,000 for injury or death to one person.

- $60,000 for injury or death to more than one person.

- $15,000 for property damage.

These minimum amounts may be insufficient in serious injury cases, which is why Uber’s app-based coverage periods often play a key role in determining the amount of compensation available after an accident.

Damages You Can Pursue In An Uber Injury Case

Once you establish liability, you can pursue damages for the losses you suffered because of the Uber accident. These damages reflect both the financial impact of your injuries and how they affect your daily life. Questions such as “Does Uber pay for car damage?” often arise alongside injury-related losses, especially when vehicle repairs or replacement become part of the claim.

Common recoverable damages include:

- Medical expenses

- Lost wages

- Reduced earning capacity

- Pain and suffering

- Emotional distress

- Loss of enjoyment of life

Insurers evaluate damages by reviewing the severity of your injuries, how long your recovery takes, and how the injuries affect your ability to work and function day to day. Together, liability and damages determine the overall value of an Uber personal injury settlement.

Frequently Asked Questions (FAQs)

Uber personal injury claims often raise questions about compensation, insurance, and the claims process. The answers below address common concerns and explain what to expect when pursuing a settlement after an Uber accident.

How Much Money Will I Get From The Uber Settlement?

The amount you may receive from an Uber settlement is determined by factors such as your injuries, medical treatment, and the insurance coverage available in your case.

Since Uber’s insurance changes based on the driver’s status, similar accidents can result in different settlement amounts. Insurers rely on medical records, liability evidence, and documented losses when evaluating a claim.

What Are The Signs Of A Good Settlement Offer?

A good settlement offer covers your documented losses and reflects the impact of your injuries. The offer accounts for both financial costs and personal harm caused by the Uber accident.

Signs of a reasonable settlement offer include:

- Payment for all related medical expenses.

- Coverage for lost wages and reduced earning capacity.

- Compensation for pain and suffering.

- Consideration of future medical needs.

- Alignment with available insurance limits.

Insurers base settlement offers on medical records, proof of liability, and the extent of your injuries. A strong offer reflects the full scope of your losses rather than only immediate costs.

How Do I Negotiate A Higher Settlement?

You can negotiate a higher settlement by presenting clear evidence and understanding the full value of your claim. Many injured people reach a point where they think, “I need a personal injury lawyer,” especially when insurers push back or make low offers.

Steps that can strengthen negotiations include:

- Gathering complete medical records and bills.

- Documenting lost wages and work limitations.

- Preserving evidence supporting fault.

- Waiting until your medical condition stabilizes before negotiating.

- Not accepting the first offer without review.

What Happens If I Reject A Settlement?

If you reject a settlement offer, the claim usually continues. The insurance company may respond with a higher offer or ask for more information. If negotiations stall, the case may proceed to a lawsuit.

At this stage, many injured people seek free legal advice from an accident lawyer to review the offer and understand their next steps. An attorney can explain the risks and help you decide whether to continue negotiating or move forward with litigation.

Understand Your Uber Personal Injury Settlement With Legal Guidance

Uber personal injury settlements depend on several factors. Insurance coverage, fault, and damages all influence the outcome. A skilled attorney can review these details and explain how they apply to your case.

The Uber accident lawyers at Arash Law can:

- Review the Uber driver’s app status and insurance coverage.

- Analyze liability under California negligence law.

- Evaluate medical records and income loss.

- Identify all recoverable damages.

- Explain how settlement offers compare to your documented losses.

If you suffered injuries in an Uber accident, legal guidance can help you understand the factors that affect your settlement and the steps to take next. To speak with a legal professional, call AK Law at (888) 488-1391.