What are Uninsured Motorist and Underinsured Motorist Coverage?

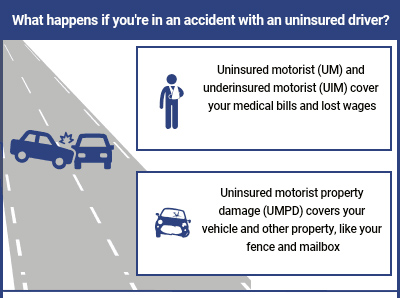

Uninsured motorist (UM) coverage pays for damages caused by another driver who does not have any insurance. Underinsured motorist (UIM) coverage pays for damages caused by a driver whose insurance coverage is not enough to pay the full amount of your financial losses (“damages”).

As you will see, these are essential coverages that can protect you from devastating financial losses. It is, therefore, crucial to have this coverage even though California law does not require drivers to carry it.

Like most California drivers, you are probably concerned about the rising cost of auto insurance. State law requires all drivers to carry certain coverage, but in order to reduce the cost of auto insurance premiums, many drivers opt-out of additional coverage beyond the minimum legal requirement.

This can be a big mistake. If you are hit by a driver who doesn’t have auto insurance, or just carries the minimum legal coverage, you could be left to pay expensive medical bills and other costs even though the accident wasn’t your fault. You and your family could be left in a terrible financial crisis as the result of another driver’s negligence. Don’t let this happen to you.

What Does UM/UIM Insurance Cover?

What Does UM/UIM Insurance Cover?

UM/UIM coverage can ensure that your accident-related losses are covered, regardless of the other driver’s insurance coverage. In fact, it can cover both your economic and non-economic losses after a severe car accident. Here are some of the specific damages you can recover through uninsured/underinsured motorist coverage:

- Medical expenses

- Property damage, including vehicle repair bills and damage to other property

- The cost of a rental vehicle

- Lost income

- Physical and emotional pain and suffering

- Lost quality of life

- Mental and emotional distress

At Arash Law, We Help Victims Get the Compensation They Deserve after Serious Car Accidents

It is essential to understand the many different types of coverages that are available on your auto insurance policy. This allows you to plan ahead and avoid disastrous financial consequences. A personal injury lawyer can help you access coverage under the at-fault driver’s insurance policy. If that driver doesn’t have insurance or has insufficient coverage to pay for all of your bills, you may be able to file a claim under your own policy. It is essential to get legal advice from an attorney who knows how to find all possible insurance coverage.

Call (888) 488-1391 today to schedule your consultation with an experienced California personal injury attorney. At Arash Law, our aggressive car accident lawyers have won over $500 million for personal injury victims. Let us help you and your family access the compensation you deserve.

How an Uninsured Motorist claim works:

- You are hit by a driver who does not carry liability insurance. (That is a violation of state law, but some California drivers do choose to break that law.)

- You obtain a police report documenting that the accident was the other driver’s fault and that he or she provided no proof of insurance to the law enforcement officer who responded to the scene.

- You open a claim with your own auto insurance company.

- Your insurance company verifies that the other driver does not have insurance.

- Your insurance company must then offer to settle your claim. The amount offered must include compensation for medical bills, lost wages, pain and suffering, property damage, and any other financial losses caused by the other driver’s negligence.

- If you are able to negotiate a settlement of the claim, your insurance company will pay you. (This is why it is vital to have an experienced personal injury attorney negotiating a fair amount for your claim.)

- If your insurance company refuses to offer a fair settlement, you may have to file a lawsuit to encourage them to make a reasonable settlement offer.

- If your insurance company still does not make a fair settlement offer, you may have to take the case to trial and let a jury determine the fair value of your claim. It is crucial to hire an experienced trial attorney who knows how to convince a jury of the fair amount of a personal injury claim.

How an Underinsured Motorist claim works:

- You are hit by a driver who has auto insurance.

- You file a personal injury claim with the other driver’s insurance company. They agree that their driver was at fault. (This is known as “accepting liability.”)

- Your medical bills lost wages, and other financial losses are more than the driver’s policy limits. (Currently, California requires minimum coverage of $15,000 per person and $30,000 per accident. This amount can go surprisingly quickly.)

- The other driver’s insurance company pays you the policy limits. (They are not legally obligated to pay you more.)

- You file a UIM claim with your own insurance company.

- Your insurance company verifies that the accident was the other driver’s fault and that his or her auto insurance policy limits have been met and paid.

- Your insurance company then determines the value of your claim. They will make a settlement offer for the amount beyond the other driver’s policy limits. (For example, if your total claim was worth $25,000 and the other driver’s insurance paid you $15,000, your own insurance company would pay you $10,000.

- Again, you may have to negotiate with your insurance company to get a fair settlement offer. It is essential to be represented by an aggressive personal injury attorney who will fight for the fair value of your claim.

If your insurance company refuses to make a fair settlement offer, you might have to file a lawsuit and let a jury determine the fair value of your claim.

Why is it Important to Have UM and UIM Coverage?

You might think that it isn’t fair to pay for UM or UIM coverage. After all, these coverages only apply if another driver is at fault for your accident. Should the person at fault have to pay for all your losses? The short answer is yes. The law does impose an obligation to compensate for a car accident victim for all of his or her financial losses that were caused by negligent driving.

Unfortunately, without insurance coverage, it can be nearly impossible to get payment from a negligent driver. The time and expense of trying to get a judgment against the driver and enforce it is almost never worth the hassle.

For this reason, most California auto accident victims are left with whatever insurance coverage the at-fault driver has.

Some drivers violate the law by carrying no insurance coverage at all. This is not fair, but it happens. Even drivers who carry the minimum legal insurance coverage may not have enough to pay for all of your losses. $15,000 does not go very far when your injuries are severe or will cause permanent damage. In fact, this amount can easily be used up in one day’s stay at the hospital. It is vital to protect yourself from these added costs that may not be covered by another driver’s insurance company. Here are some of the drastic consequences that can happen without UM or UIM coverage:

Scenario 1: The Uninsured Motorist

You are struck by another driver from Orange County who does not carry auto insurance. This driver has broken state law. He is issued tickets for both the traffic offense and his lack of insurance. Unfortunately, you do not have UM coverage, and there is absolutely no auto insurance available to you. Your health insurance covers a portion of some of your medical bills, but not all of them. You miss work as a result of the car accident in Irvine. Your missing paychecks stretches your family income, which is already burdened by your medical bills. Despite the fact that the other driver was at fault for the accident and broke the law by driving without insurance, you have no way to be compensated for either your medical bills or your lost wages.

Scenario 2: The Underinsured Motorist

You are struck by a driver in Bakersfield who carries the minimum legal insurance coverage. His insurance company agrees that he was at fault and pays the $15,000 policy limit. In the meantime, your severe injuries have required a lot of medical attention. You had surgery and spent a week in the hospital. You require several weeks of physical therapy. You miss months of work and eventually are only able to return part-time. This drastically reduces your family income. The other driver did follow the law regarding auto insurance, but $15,000 has barely put a dent in your medical bills (which now total hundreds of thousands of dollars). You don’t know when you might be able to return to work full time. This jeopardizes your health insurance coverage, which was the only thing keeping your medical bills in check. Your family is now in a precarious financial situation with no clear end in sight.

The Facts About Uninsured and Underinsured Motorists

According to the Insurance Information Institute, approximately 12 to 16 percent of American drivers do not carry any auto insurance. (This is based on annual estimates from 1992 to 2007, which ranged from 12.3 to 16.0 percent.) Here in California, the 2015 estimate was 15.2 percent. This made us the twelfth highest state for uninsured drivers. This means that approximately 15 percent of all innocent California auto accident victims will have no auto insurance available to them without UM or UIM coverage.

It is also important to remember that there is an additional percentage of injury victims who won’t have enough insurance available to them. The Rocky Mountain Insurance Information Association reports that the average bodily claim in 2013 cost $15,443. This means that the average claim already costs more than California’s minimum $15,000 coverage. And of course, this is only the average. Personal injury claims involving death, paralysis, and other permanent disabilities can easily run into the millions of dollars. Even in these catastrophic cases, the insurance company only has the legal obligation to pay policy limits. This can leave a disabled injury victim with only $15,000 to cover millions of dollars worth of medical expenses. Lost wages, decreased future income, pain, and suffering, loss of enjoyment of life, and other damages will be left entirely uncompensated.

Will I Have to Pay More for Auto Insurance if I File a UM or UIM Claim?

Auto insurance premiums are calculated by your risk rating. Causing an accident increases your risk rating, which is why your premiums can increase if a claim is filed against you. But UM and UIM claims can only be submitted if someone else caused the accident. For this reason, merely filing a UM or UIM claim does not automatically trigger increases in your premiums.

However: being involved in multiple car accidents (regardless of who was at fault) can increase your risk rating. This is an indirect way some insurance companies will justify an increase in premiums. This possibility should not discourage you from filing a UM or UIM claim. You are legally entitled to the benefits of coverage you have paid for.

Think of UM or UIM coverage as a type of health insurance. If you file lots of claims, your health insurance company might consider you to be unhealthy and increase your premiums. But this doesn’t stop you from seeing doctors and getting the medical attention you need. It is a better financial strategy to be proactive and address health problems before they get worse. This is the same with injuries after an auto accident. If you don’t get the right medical care as soon as possible, your injuries can get worse or last longer.

Worse still, unpaid medical bills and lost wages can be financially devastating for any family. Stay ahead of this problem by accessing all insurance coverage to which you are entitled. Time is limited, don’t wait – seek help from a reputable car accident injury attorney who has comprehensive experience filing uninsured & underinsured motorist-related insurance claims in California.

Call Arash Law to Schedule a Free Case Evaluation with a California Personal Injury Attorney

Accidents caused by drivers with little or no insurance coverage can be physically, financially, and emotionally devastating. You can protect yourself from desperate circumstances with UM and UIM coverage. Whether you are filing a claim under your coverage or the at-fault driver’s coverage, a personal injury attorney can protect your rights to compensation. Call Arash Law at (888) 488-1391 or contact us online today to schedule a consultation.

Our experienced California personal injury lawyers know how to deal with insurance company tactics. They fight hard to defend your legal rights. They can help protect your legal right to be fully and fairly compensated for all the tangible and intangible losses you sustain as the result of a car accident. Our UM/UIM claim accident lawyers are conveniently located in Los Angeles, San Diego, Sacramento, San Jose, San Francisco, Riverside, and Woodland Hills, but regardless of where in California you are – our A+ rated injury attorneys can come to you! Call us 24-7, 365! We offer, hassle-free, complimentary consultations without an obligation to sign with our UIM/UM accident injury firm! Our toll-free number is (888) 488-1391 – our lawyers are standing by.

What Does UM/UIM Insurance Cover?

What Does UM/UIM Insurance Cover?